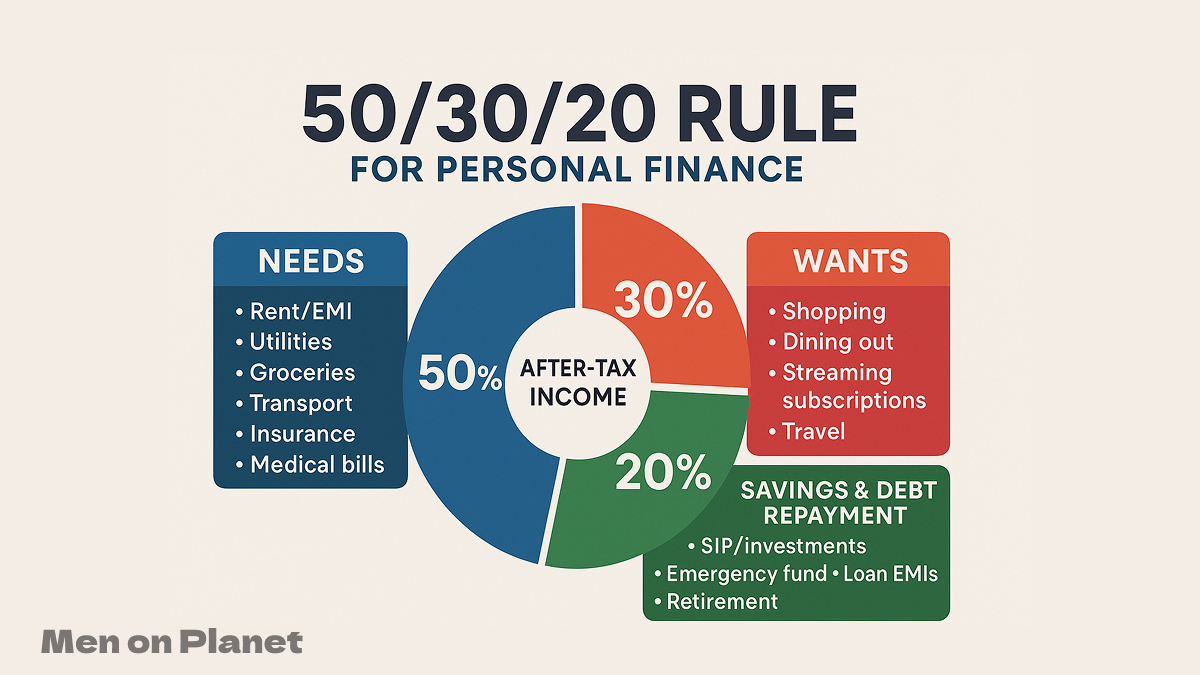

The 50/30/20 Rule for Personal Finance is one of the simplest ways to manage money without feeling overwhelmed. It breaks your after-tax income into three clear buckets: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

For Indians looking to build smart money habits, this method offers a beginner-friendly approach that balances everyday expenses with future goals. By following this rule, you can create financial discipline, reduce money stress, and steadily work toward long-term stability.

What is the 50/30/20 Budgeting Rule?

The 50/30/20 rule is a simple and effective personal budgeting method that helps you manage your money by dividing your after-tax income into three main categories:

- 50% for Needs (Essential expenses)

- 30% for Wants (Lifestyle expenses)

- 20% for Savings & Debt Repayment (Future financial security)

This budgeting method was popularized by Harvard bankruptcy expert Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.” It’s particularly effective for beginners who want to start taking control of their finances without getting overwhelmed by complex budgeting systems.

Why Use the 50/30/20 Budgeting Rule?

According to financial planning experts, the 50/30/20 rule offers several advantages:

- Easy to follow and apply – No complex calculations required

- Helps avoid overspending – Clear spending limits for each category

- Builds strong savings foundation – Automatic 20% allocation to future goals

- Encourages mindful spending habits – Forces you to categorize expenses

- Flexible framework – Can be customized based on individual circumstances

Also Read: How to start SIP in India

Breaking Down the 50/30/20 Rule: Detailed Categories

50% for Needs – Essential Expenses

These are non-negotiable expenses you must pay to live and work in India:

Housing & Utilities:

- Rent or home loan EMI

- Property maintenance charges

- Electricity, water, gas bills

- Internet and phone bills

Transportation:

- Fuel costs or public transport

- Vehicle insurance and maintenance

- Parking fees

Basic Living Expenses:

- Groceries and household items

- Basic clothing requirements

- Essential medical expenses

Insurance & Taxes:

- Health insurance premiums

- Life insurance premiums

- Tax obligations

💡 Expert Tip: If your needs exceed 50%, consider relocating to a more affordable area, finding roommates, or exploring additional income sources.

30% for Wants – Lifestyle Expenses

These are non-essential expenses that improve your quality of life but aren’t mandatory for survival:

Entertainment & Leisure:

- Dining out and food delivery

- Movies, concerts, and events

- Streaming subscriptions (Netflix, Amazon Prime)

- Hobbies and recreational activities

Personal & Lifestyle:

- Fashion and shopping beyond basics

- Salon and spa treatments

- Gym memberships

- Travel and weekend getaways

Upgrades & Conveniences:

- Premium food items

- Latest gadgets and electronics

- Home décor and non-essential furniture

💡 Expert Tip: Be honest about categorizing expenses. Ask yourself: “Would I survive without this?” If yes, it’s likely a want.

20% for Savings & Debt Repayment – Future Financial Security

This portion goes toward building wealth and achieving financial freedom:

Emergency Fund:

- 3-6 months of expenses in liquid savings

- Keep in high-yield savings accounts or liquid funds

Investment & Wealth Building:

- SIPs in mutual funds

- ELSS for tax savings

- PPF contributions

- NPS investments

- Direct equity investments

Debt Repayment:

- Credit card outstanding beyond minimum payments

- Personal loan EMIs

- Extra payments toward home loan principal

Long-term Goals:

- Children’s education fund

- Retirement planning

- Down payment for property

- Wedding expenses

💡 Expert Tip: Automate your savings through SIPs and automatic transfers to make it a habit, not a choice.

Practical Example: 50/30/20 Rule on ₹60,000 Take-Home Salary

| Category | Percentage | Amount (INR) | Typical Allocation |

| Needs | 50% | ₹30,000 | Rent (₹15,000), Groceries (₹6,000), Utilities (₹3,000), Transport (₹4,000), Insurance (₹2,000) |

| Wants | 30% | ₹18,000 | Dining out (₹6,000), Entertainment (₹4,000), Shopping (₹5,000), Miscellaneous (₹3,000) |

| Savings/Debt | 20% | ₹12,000 | Emergency fund (₹4,000), SIP (₹6,000), PPF (₹2,000) |

Can You Customize the 50/30/20 Rule?

Absolutely! The 50/30/20 rule serves as a starting point. Based on your financial situation and goals, you can adjust:

Alternative Ratios:

40/30/30 Rule: For aggressive savers or those planning early retirement 60/20/20 Rule: For high-cost metro cities like Mumbai or Delhi 50/20/30 Rule: For those with high debt or immediate major expenses

When to Customize:

- High-income earners: May allocate more than 20% to savings

- Young professionals: Might temporarily increase wants percentage

- Near retirement: Should increase savings percentage significantly

- High debt burden: May need to allocate more to debt repayment initially

50/30/20 Rule vs Other Budgeting Methods

| Method | Complexity | Best For | Key Feature |

| 50/30/20 Rule | Simple | Beginners | Broad categories |

| Zero-Based Budgeting | Complex | Detail-oriented people | Every rupee allocated |

| Envelope Method | Moderate | Cash users | Physical spending limits |

| Pay Yourself First | Simple | Serious savers | Savings prioritized |

Implementation Tips for Indian Households

Start Small and Build Gradually:

- Track expenses for 2-3 months to understand current spending patterns

- Calculate accurate take-home income after taxes and deductions

- Categorize existing expenses into needs, wants, and savings

- Make gradual adjustments rather than drastic changes

Indian-Specific Considerations:

- Joint family expenses: Clearly define individual vs. shared costs

- Festival spending: Budget for annual festivals and celebrations

- Seasonal variations: Account for monsoon repairs, wedding seasons

- Cash transactions: Track cash expenses diligently

Tools to Help Implementation:

- Budgeting apps: Mint, YNAB, or Indian apps like Walnut

- Bank auto-debit: Set up automatic transfers to savings

- Expense tracking: Use apps or simple spreadsheets

- Regular reviews: Monthly budget assessment and adjustments

When NOT to Use the 50/30/20 Rule

The 50/30/20 rule may not be suitable if you:

- Have extremely high debt (consider debt avalanche method first)

- Are in a financial emergency (focus on essentials only)

- Have very low income (needs may exceed 50% temporarily)

- Are planning major life changes (marriage, job switch, relocation)

- Have complex financial goals requiring detailed planning

Common Mistakes to Avoid

- Miscategorizing expenses – Being too lenient with “needs”

- Not tracking spending – Failing to monitor actual vs. planned expenses

- Ignoring inflation – Not adjusting categories annually

- Skipping emergency fund – Jumping to investments without safety net

- Being too rigid – Not adapting to life changes

Success Stories: Real Indian Examples

Case Study 1: Priya, 28, Software Engineer, Bangalore

- Salary: ₹80,000 take-home

- Challenge: High rent and lifestyle inflation

- Solution: Shared accommodation, reduced dining out

- Result: Built ₹2 lakh emergency fund in 10 months

Case Study 2: Raj, 35, Marketing Manager, Mumbai

- Salary: ₹1.2 lakh take-home

- Challenge: Credit card debt of ₹3 lakhs

- Solution: Modified to 50/20/30 (extra 10% for debt)

- Result: Cleared debt in 18 months while maintaining lifestyle

FAQs About the 50/30/20 Budgeting Rule

1. Can I use the 50/30/20 rule if my income is irregular?

Yes, freelancers and those with variable income can use this method. Calculate your average monthly income over the past 6-12 months and apply the rule. During high-income months, allocate more towards savings to balance low-income periods.

2. What if my needs exceed 50% of my income?

This is common in metro cities. Consider:

- Reducing housing costs (shared accommodation, location change)

- Cutting non-essential “needs” like premium services

- Temporarily reducing wants percentage

- Exploring additional income sources

3. Is the 50/30/20 rule better than detailed budgeting?

For beginners, yes. It’s simple and sustainable. However, as your income grows or financial goals become complex, you may need detailed budgeting or goal-based planning for better control.

4. How do I handle irregular expenses like annual insurance premiums?

Create a separate “sinking fund” within your savings category. Divide annual expenses by 12 and save monthly for these costs.

5. Should I include tax savings in the 20% category?

Yes, tax-saving investments like ELSS, PPF, and NPS should be part of your 20% allocation as they serve dual purposes of savings and tax benefits.

Final Thoughts: Building Financial Discipline

The 50/30/20 rule is more than just numbers—it’s a mindset shift toward conscious spending and systematic saving. By following this budgeting method consistently, you’ll:

- Gain control over your finances

- Reduce financial stress and anxiety

- Build wealth systematically

- Develop healthy money habits

- Move closer to financial independence

Remember, the best budget is one you can stick to long-term. Start with the 50/30/20 rule, track your progress, and adjust as needed. Financial freedom isn’t about perfection—it’s about consistent progress toward your goals.

Key Takeaway: Start implementing the 50/30/20 rule today, even if imperfectly. Small, consistent steps toward better money management will compound into significant financial improvements over time.

Disclaimer

Important Financial Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be construed as professional financial advice. The 50/30/20 budgeting rule is a general guideline and may not be suitable for all individuals or financial situations.

Please consider the following:

- Individual Circumstances: Your personal financial situation, goals, income stability, and risk tolerance may require different budgeting approaches

- Professional Advice: Consult with qualified financial advisors, chartered accountants, or certified financial planners before making significant financial decisions

- Investment Risks: All investments carry inherent risks, and past performance does not guarantee future results

- Tax Implications: Tax laws and regulations change frequently; consult tax professionals for current advice

- No Guaranteed Results: Following the 50/30/20 rule does not guarantee financial success or specific outcomes

The authors and publishers of this content:

- Are not liable for any financial losses resulting from the use of this information

- Do not provide personalized financial advice

- Recommend seeking professional guidance for complex financial planning

- Update content regularly but cannot guarantee real-time accuracy of all information

Please conduct your own research and consider your unique financial circumstances before implementing any budgeting strategy. Financial planning should be tailored to your specific needs, goals, and risk tolerance.

Published: July 7, 2025 | Last Updated: July 17, 2025